Indicators on Renters Insurance You Need To Know

Wiki Article

Examine This Report on Life Insurance

Table of ContentsCar Insurance Fundamentals ExplainedAll about Car Insurance QuotesSome Ideas on Car Insurance Quotes You Need To KnowHow Renters Insurance can Save You Time, Stress, and Money.Our Health Insurance PDFs

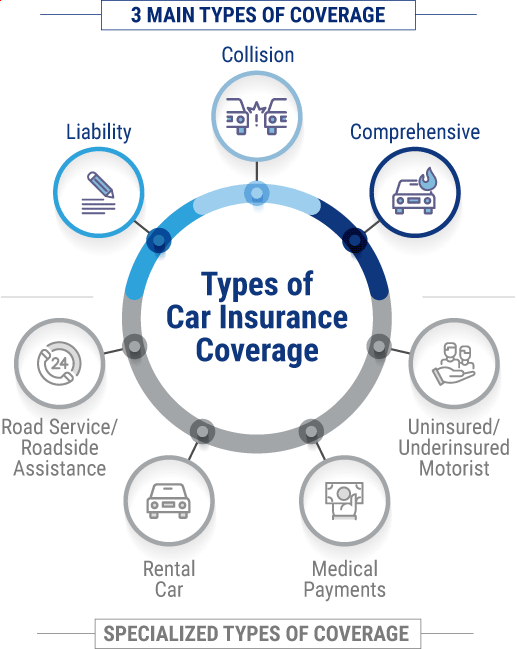

We motivate you to talk to your insurance coverage representative as well as to review your policy agreement to fully comprehend your coverages. * Some discount rates, coverages, repayment strategies and functions are not readily available in all states or all GEICO companies. Protection is subject to the terms, limitations and also problems of your policy contract.by Valerie Hawkins Opportunities are, if you own a cars and truck, and you're a righteous person, you have auto insurance coverage. And also although auto insurance is among one of the most usual kinds of insurance available there are a great deal of sickening, confusing terms that go along with it. Do not allow insurance policy mumbo-jumbo obtain you overwhelmed.

Consider them as peanut butter and chocolate. Ok by themselves. With each other, magic. Occasionally, when you have extra questions than answers on confusing insurance terms, it might seem simpler to do nothing whatsoever. So, whether you're securing things you like or getting ready for tomorrow, don't get overwhelmed, get going.

How Health Insurance can Save You Time, Stress, and Money.

If you need to see an expert, you are called for to obtain a reference. Nonetheless, like a PPO, you can additionally pick to see specialists that are in-network or out-of-network. If you see a physician outside the plan's network, your share of the expenses will be higher and you'll be accountable for filing any type of insurance claims yourself.You may also pick to see companies from outside of the plan's network, but you will pay more out-of-pocket. Choosing a medical care provider (PCP) is not called for with these kinds of health insurance, and also you can see experts without a reference. What sorts of health insurance policy are best for me? Beginning by comprehending your particular healthcare demands: health and wellness insurance plans with greater deductibles usually have lower insurance policy premiums and can assist in saving you money.

I have a persistent condition. What sorts of health and wellness insurance are best for me? Chronic problems might call for regular drug and even more constant physician consultations, even expensive medical facility remains and/or surgeries. Consider a health insurance plan that assists decrease out-of-pocket costs based upon what you expect for doctor care, professional gos to, prescription medicines, and so on.

Employees have an annual deductible they'll be needed to fulfill prior to the insurance company begins covering their medical expenses. They might additionally have a copayment for certain services or a co-insurance where they are accountable for a portion of the overall costs. Providers beyond the network typically result in a higher out-of-pocket cost.

The Ultimate Guide To Insurance

HSAs can be connected to team health insurance coverage, companies can contribute to the account whether they use a team policy or not, and also the account goes with the employee when they leave the business.Funds might be withdrawn for other costs too but will certainly incur charges as well as passion if you're under 65 years old. Can't pay for a reduced deductible health and wellness strategy Desired to have greater control over just how much you add to wellness check out here benefits Have a a great deal of staff members that already have an HSA 7.

Group protection HRA (GCHRA) The GCHRA, additionally known as an incorporated HRA, is a health benefit for employers providing a team medical insurance plan, typically a high deductible health insurance plan (HDHP). With the GCHRA, companies establish their staff members' allocation which they can make use of every month on deductibles, copays, and also out-of-pocket expenditures as a supplement to the team strategy.

Due to the fact that it's a team insurance coverage HRA, just staff members taking part in the firm's team wellness insurance policy strategy are qualified to make use of the advantage. Verdict There private health insurance are several health insurance plan around, yet recognizing the primary kinds of health and wellness insurance coverage can make whatever less frustrating. As we understand, wellness insurance policy is not one-size-fits-all, as well as the number of options reflects that.

The Ultimate Guide To Insurance

Security under these agreements runs out at the end of the stated period, with no cash value staying.The cash money worth, which is less than the stated value of the policy, is paid to the insurance policy holder when the agreement grows or is given up. Universal life agreements, a relatively new form of protection introduced in the United States in 1979, have actually ended up being a significant course of life insurance policy. They permit the proprietor to decide the timing and size of the premium and amount of death benefits of the plan.

There are two general kinds of global life contracts, type An and kind B. In type-A policies the survivor benefit is a collection amount, while in type-B temporary car insurance plans the survivor benefit is a collection quantity plus whatever money value has actually been accumulated in the policy. Life insurance policy might likewise be categorized, according to kind of customer, as regular, team, commercial, and credit rating.

Almost all normal life insurance coverage plans are provided on a level-premium basis, which makes it essential to charge even more than real price of the insurance coverage in the earlier years of the contract in order to offset much higher prices in the later years; the so-called overcharges in the earlier years are not actually overcharges however are a necessary part of the complete insurance coverage strategy, showing the reality that mortality prices increase with age.

Car Insurance Quotes Things To Know Before You Buy

The insured does not, however, have a claim on all the profits that accumulate to the insurance coverage business from investing the funds of its insurance holders. By incorporating term and also entire life insurance policy, an insurer can provide various type of policies. Two examples of such "plan" agreements are the family members revenue plan and the home loan security policy.In the case of the mortgage defense agreement, for instance, the amount of the decreasing term insurance coverage is developed roughly to approximate the quantity of the home loan on a residential or commercial property. As the mortgage is repaid, the quantity of insurance coverage declines alike. At the end of the home loan period the lowering term insurance policy ends, leaving the base policy still effective (travel insurance).

Some whole life plans permit the insured to restrict the period throughout which premiums are to be paid. Usual examples of these are 20-year life, 30-year life, and also life paid up at age 65. On these contracts, the insured pays a greater costs to make up for the limited premium-paying duration.

Term insurance is most ideal when the requirement for protection competes just a restricted duration; whole life insurance is most proper when the protection demand is permanent. The global life plan, which makes passion at a rate about equal to that gained by the insurance company (approximately the price readily available in long-lasting bonds and also mortgages), might be used as a practical lorry by which to save cash.

Report this wiki page